What’s Actually Happening with Home Prices Today?

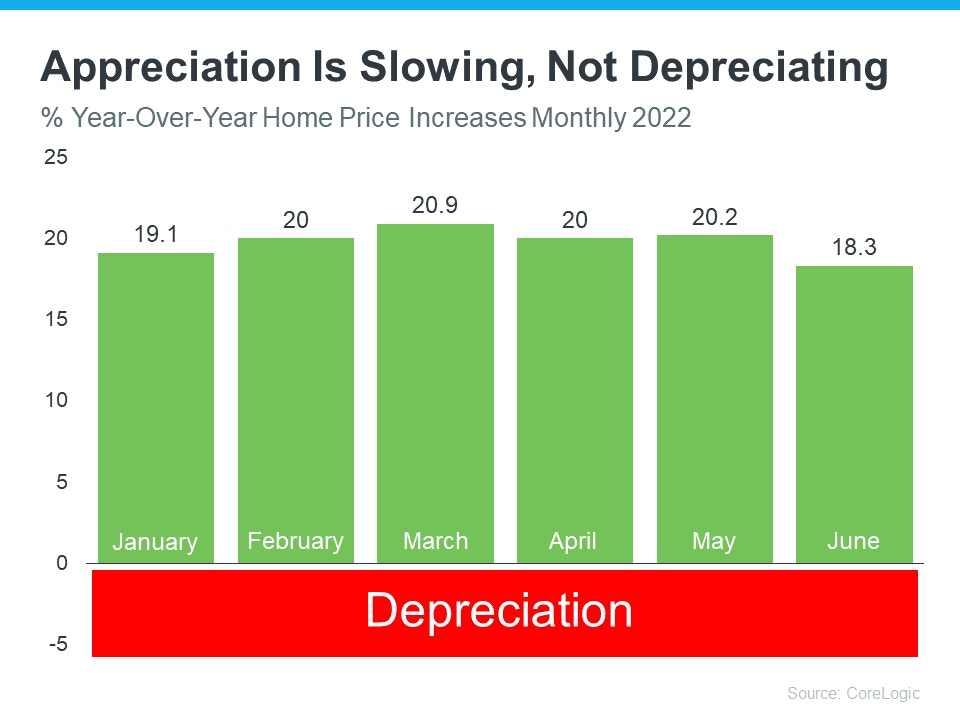

One of the biggest questions people are asking right now is: what’s happening with home prices? There are headlines about ongoing price appreciation, but at the same time, some sellers are reducing the price of their homes. That can feel confusing and makes it more difficult to get a clear picture.