Here at 5Market Realty, we provide monthly video updates on the local real estate market along with a national market update. By tracking the number of sales, sold prices, and the days on market, we try to keep ourselves and our clients informed on what is happening in real estate. While these videos are useful, sometimes the written word helps to provide the best explanation. With that in mind, I set out to provide a brief post explaining where home prices are at the end of the year.

The rapid appreciation of real estate has been a central story in the economy since covid entered our world. Across the county, we saw people’s needs change and what they needed in home began to change as well. Furthermore, working from home became an option to more and more people as we managed through the pandemic. This created a supply and demand issue in real estate. In the Athens and Oconee area, we saw a surge of people wanting to move into our area. Many of these buyers were from the Atlanta area or UGA alumni, but a surprising amount came from all over the country without direct ties to the university. While the demand was rising, our interest rates remained at historical lows. In our company, we saw many clients purchase a home with a rate below 3.5%, and in some cases, below 3%. At the same, money was being handed out by the government for numerous reasons to businesses and individual people to manage through the pandemic. All these factors contributed to one of the most frantic real estate markets we have ever experienced.

Trees don’t grow to the sky and most of us believed that the housing market needed to cool down. As we entered 2022, the market remained red hot with high demand and low supply, but then inflation reared its ugly head. Due to energy costs, supply chain issues, and other factors, inflation was getting out of control. To try and tame inflation, the federal reserve began to increase interest rates at a rapid pace back in April. Over the course of 2022, interest rates more than doubled which represents the fastest rise in rates since it has been tracked over the last 50 years. The goal of these rate increases was to help tame inflation, but also to slow down the housing market which has occurred over the last 6 months.

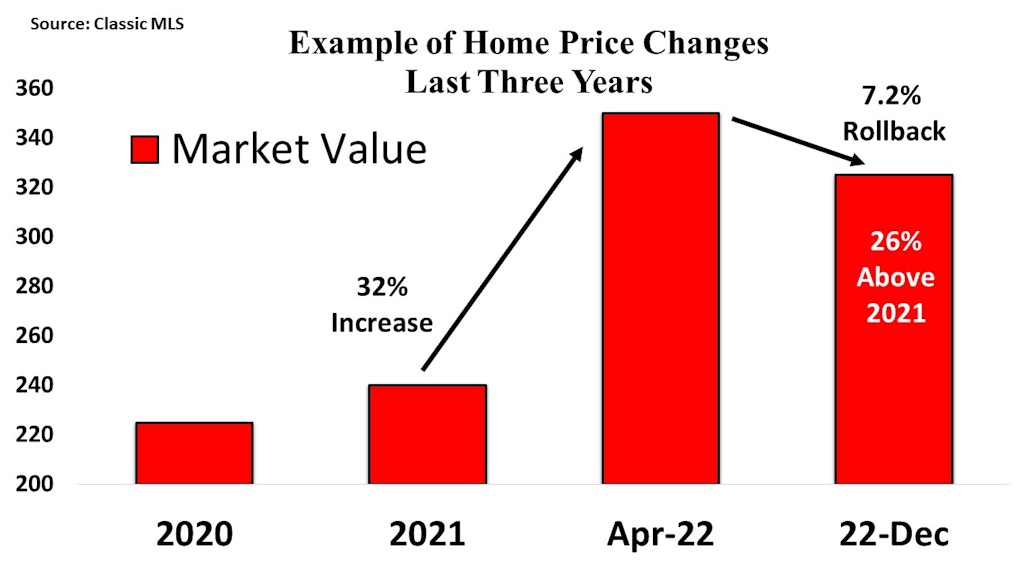

There is a lot talk about decreasing home prices, and while in some cases it might technically be true, it does not tell the whole story. What we are seeing in our area is a roll back from the height of March and April. Keep in mind, this is not universal. Several areas have seen no roll back on price whereas others are seeing prices come down anywhere from 5% to 10%. Look at the graph pictured below.

This represents a home at a lower price point around the Athens area. From 2020 to 2021, you can see a modest level of appreciation. Then from 2021 to 2022, the price skyrocketed over 30% to $350,000. Now, at the end of the year and after the rise in interest rates, similar homes in the neighborhood are selling around $325,000 which is around 7% less. On the other hand, the home value is still significantly up from 2021. This may not be good news for the person who purchased in April, but keep in mind they likely have an interest rate well below 5%. As we enter 2023, most experts are forecasting home prices to remain flat and then appreciate more in 2024 and 2025.

Bottom Line

Due to inflation and interest rates, our market has been volatile. Thankfully, inflation has shown signs of cooling down over the last two months. If inflation continues to lower, that will help stabilize interest rates and the real estate market. Ultimately, the goal is to reach a more balanced market with slower appreciation and more opportunities for home buyers. Just look at this quote from Jerome Powell in June of 2022.

“I’d say if you are a home buyer or a young person looking to buy a home, you need a bit of a reset. We need to get to a place where supply and demand are back together, and where inflation is down low again, and mortgage rates are low again.”

Jerome Powell, Chair, Federal Reserve- June 2022 Forbes