Athens, GA Real Estate Review | 2023

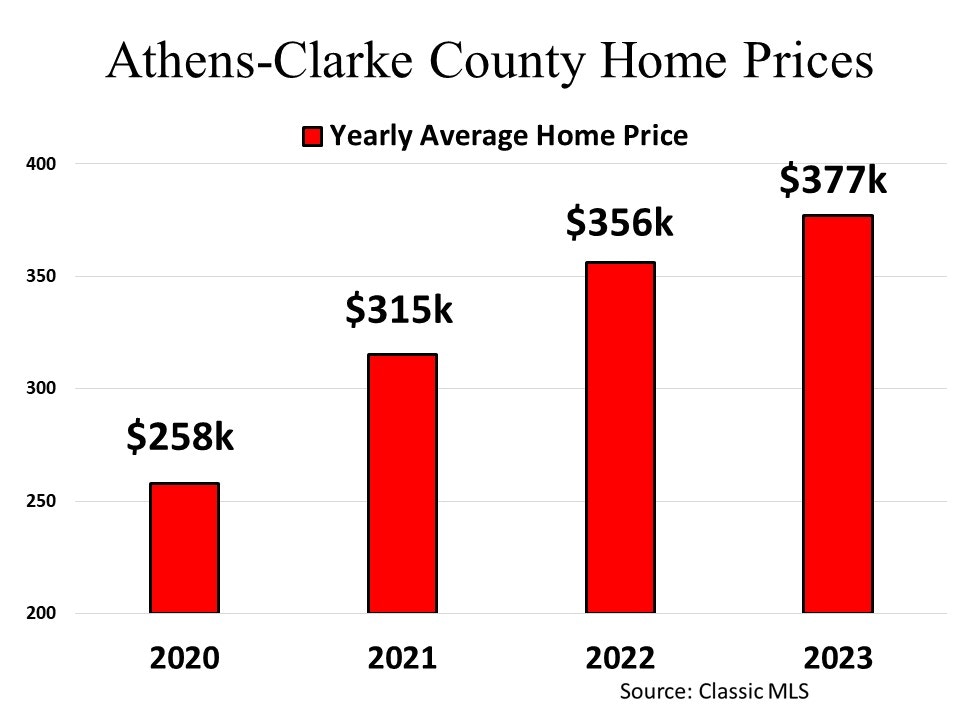

We have found that people have very contrasting opinions on home prices in the current market. Many feel that prices are coming down due to the higher interest rates while others believe that prices are rising due to the low supply of homes for sale. The truth is, prices are still going up but not as fast they were in 2020 and 2021. For example, in 2020 the average home price in Clarke County was $258,000. By the end of 2022, the average home sale price was $356,000 representing a 38% increase in just two years. As of November 30th, the average home sale price in 2023 was $377,000 which represents a 6% increase from 2022 which is more in line with historical rates of appreciation.